Customer Story

Pathward Financial Inc. – Enhancing Risk Mitigation by Reducing Threats

Introduction

Based in Sioux Falls, South Dakota, Pathward Financial Inc. is a leading provider of prepaid, credit, debit and emerging payments solutions and a leading sponsor of ATMs in the United States. Pathward was built on the vision of providing inclusive financial services for everyone.

Pathward wanted to proactively identify and mitigate information risks that could be present within its processing environment by deploying automated analysis solutions. In addition to mitigating risks, these measurements were aimed at increasing operational efficiency and integrity, while enhancing trust from its partners.

Business challenge

As a leading payment solution provider, Pathward received thousands of transactions each day from hundreds of partners like MasterCard, Visa, the Federal Reserve, other payment processors and other card associations. For phase one of its risk mitigation initiative, Pathward assessed the information risk and analysis objectives for its partner exchange and ACH reconciliation process.

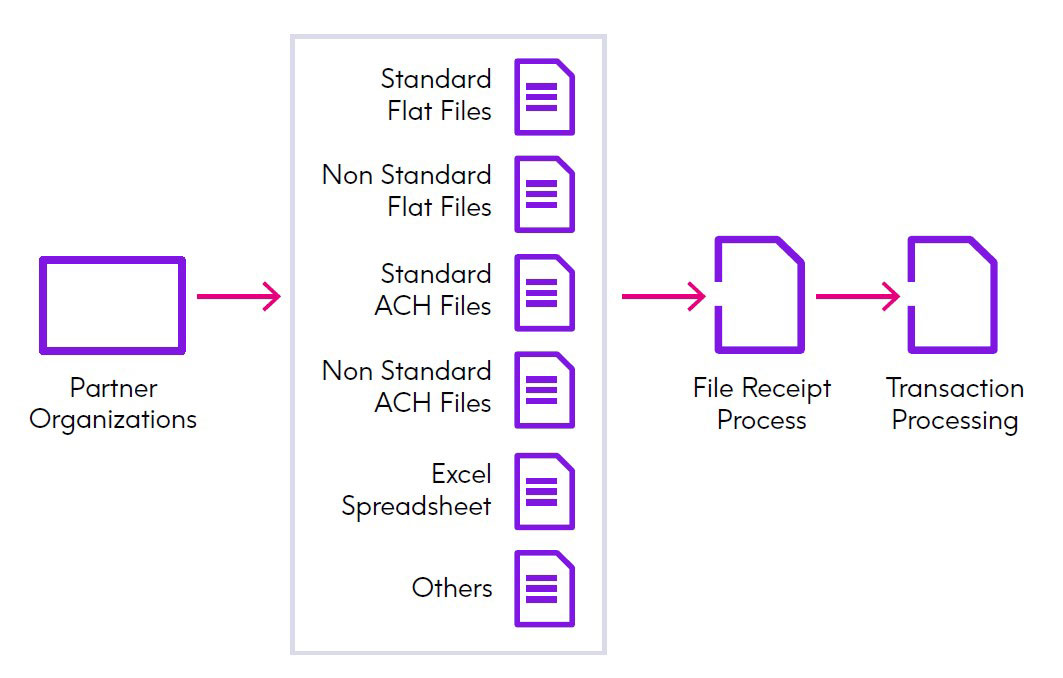

As depicted in the following diagram, Pathward received a number of files containing thousands of transactions from third party partner organizations. Once the files were received and verified, Pathward recorded and processed these transactions.

Industry

Financial

Challenges

- Detecting duplicate and inaccurate files

- Ensuring SLA contract compliance

- Discovering missing files

- Analyzing historical reasonability

Solution

Precisely data quality solution

Results

- Cost avoidance from detection of errors

- Lower cost of control by reducing manual reconciliation efforts

- SAS 70 and SSAE 16 compliance support

- SLA compliance

- Partner trust

- Competitive differentiation

“Pathward enjoyed continued growth, even amidst an environment of increasing regulatory compliance requirements. With a proactive mindset, they wanted to identify and mitigate information risks potentially present within their processing environment by deploying automated data analysis.”

Analysis objectives

Prior to processing the incoming files, Pathward wanted to ensure the integrity of the incoming transactions. Based upon internal risk assessment and leveraging industry best practices for handling third party information exchanges, Pathward established the following control objectives:

- Duplicate file analysis: Detect duplicate files upon receipt of the file from the partner, then determine if the same file was received within the last 30 days.

- Service Level Agreement (SLA) control: Ensure files are received within the given SLA for that file.

- Missing files analysis: Detect files that were expected but were not received.

- Reasonability analysis: Determine if the number of transactions present within a file is reasonable compared with historical volume information.

Operational Insight

In addition, Pathward wanted to monitor the following activities to improve operational insight about their incoming transactions:

- SLA trends by partner

- Transaction volume by product type

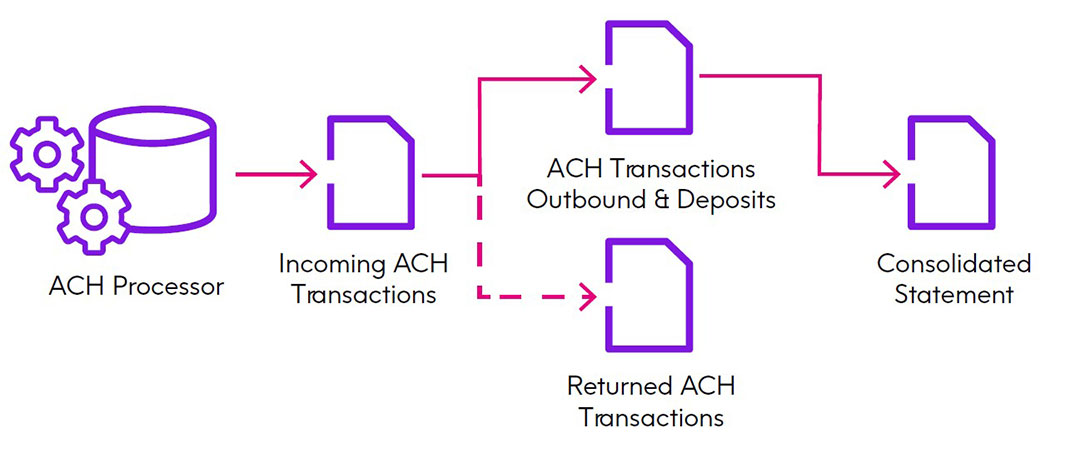

- ACH reconciliation process partner information exchange (reconciling incoming ACH transactions against daily returns and posted ACH transactions)

After evaluating the available options and determining the best approach for meeting and supporting their requirements and environmental objectives, Pathward selected Precisely for the following reasons:

- Ability to meet their functional, usability and productivity project scope

- 30-plus years of experience supporting the financial and payment processing industry

- Consistency and commitment toward customer support and client partnership

Solution

In order to meet the control objectives and achieve operational excellence and visibility, Pathward recognized the inherent need for an automated control platform and visibility solution. In support of their overall goal for proactive information risk management in all critical information processes, they identified the following requirements of the desired solution:

Functional requirements

- Data capture capability: Read various types of financial transactions (ACH, Visa, MasterCard, ISO 8583) and information repositories (partner information files, databases).

- Verification: Verify the information content and format as well as the spatial and temporal reasonability of transactions.

- Balancing: Balance information at an aggregate level as it traverses through various systems.

- Reconciliation: Reconcile information at an aggregated and transactional level.

- Tracking: Track information to ensure adherence to timeliness requirements.

- Visibility: Alert users about control exceptions

- Insight: Trend information to provide meaningful information about the business operation.

Usability & productivity requirements

- User friendly: Business users should learn to use the solution with limited and eventually no technical support.

- Productivity and usability: Need reusable rules and components to enhance scalability and drive productivity for the tester, with features like role-based visibility, wizards, and the control “copy & paste.”

- Enterprise-wide scope: Should leverage analysis designed for the partner information exchange and ACH reconciliation process to encompass the entire enterprise, both upstream and downstream processes.

Results

As part of phase one, Precisely’s data quality solution was deployed around Pathward’s partner information file exchange process and ACH reconciliation process. This gave Pathward the confidence needed to process transactions and report any inconsistencies throughout the processing cycle. Additionally, the solution was deployed to check pre-and post-settlement values within the database ensuring the values are accurate and no data had been lost.

Specific achievements:

- Cost avoidance: Reprocessing cost avoidance with the early detection of errors such as missing files, duplicate files and files with duplicate or missing transactions.

- Lower cost of analysis: Reduced manual efforts needed to reconcile ACH transactions and cycle time corresponding to ACH reconciliation processing.

- Compliance support: SAS 70 & SSAE 16 requirements met with built-in audit trail and control features.

- Faster implementation time: Analysis deployed faster in other business processes, with built-in rules and data capture capabilities.

- SLA tracking: Collaboration with payment partners to ensure timely availability of incoming transactions, helping Pathward meet its internal SLA transaction processing times.

- Operational insight: Identify trend information like transaction volume patterns by partner and product.

- Increased partner trust: Automated analysis that earned the trust of its partners.

- Competitive differentiation: A robust analysis environment that has became a competitive selling tool.

With this successful implementation, Pathward plans to deploy Precisely controls and visibility solutions in all of its critical information processes, including partner billing and reporting

Precisely data quality solutions

Drive confident data-driven decisions that reduce costs, boost revenue, increase compliance, and minimize risk with data quality solutions that meet your unique business objectives.